STAF relief measures under the OECD minimum tax (Pillar 2)

On 18 June 2023, Switzerland will vote on the introduction of the OECD minimum tax by way of a constitutional amendment. Large internationally operating corporations and their subsidiaries shall in future be subject to a minimum income tax rate of 15% in Switzerland too. In view of the already low income tax rates in Switzerland, the question arises as to whether the tax relief measures for such companies introduced within the framework of STAF will now already become obsolete. The following article explains that in individual cases significant tax advantages can actually still be achieved.

1. Background

The OECD / G20 states have agreed to further restrict international tax competition between individual states and the tax planning possibilities of multinational enterprises (MNE). To achieve this objective, a global minimum tax rate of 15% on corporate profits will be introduced by way of the so-called GloBE rules (Global Anti-Base Erosion Rules). All companies with consolidated annual revenues of at least EUR 750 million are affected.¹ A national implementation in Switzerland also seems to make sense, as otherwise, in most cases, taxation will take place abroad.

2. Key elements of the OECD minimum tax

| Calculation basis | Stand-alone financial statements according to recognised accounting standards (e.g. IFRS, Swiss GAAP FER). Financial statements based on the Swiss Code of Obligations (OR), which are decisive for income tax in Switzerland, are not sufficient, so transitions may be ecessary. |

| Relevant tax burden | MNE must calculate an effective tax rate for each state (multiple business units in a single state are consolidated in a jurisdictional blending).

The relevant profit is compared with the applicable taxes for a period within the same state. In Switzerland this includes, besides income taxes, other taxes such as real estate transfer tax, in some cases withholding tax and capital tax. The relevant profit must be calculated according to the GloBE rules. Besides deviations due to differences between recognised standards and OR accounting, further adjustment mechanisms must be considered. |

| Top-up tax | The applicable top-up tax rate is calculated based on the difference between the effective tax burden and the minimum tax rate of 15%. This differential rate is applied to the excess profit in a country. To establish the excess profit, the relevant profit is reduced by a substance-based carve-out for tangible assets and wage costs². |

| Collection procedure | Collection of the top-up tax can take place at three levels:

Switzerland envisages the introduction of all three taxation mechanisms. |

| Introduction | 140 states have committed to implementing the OECD minimum tax (but not the USA for example).

On 18 June 2023 a vote will be held in Switzerland on the constitutional amendment. If the bill is approved, it will enter into force on 1 January 2024. The EU follows a similar schedule. |

3. STAF relief measures under the OECD minimum tax

In Switzerland, the actual tax burden in most cantons is already close to or less than the minimum tax rate of 15%, even before the transition to the GloBE calculation basis. Additional tax relief measures such as the additional deduction for R&D expenses seem at first glance to no longer be interesting for MNE in low-tax cantons if the tax benefit is compensated for by the top-up tax.

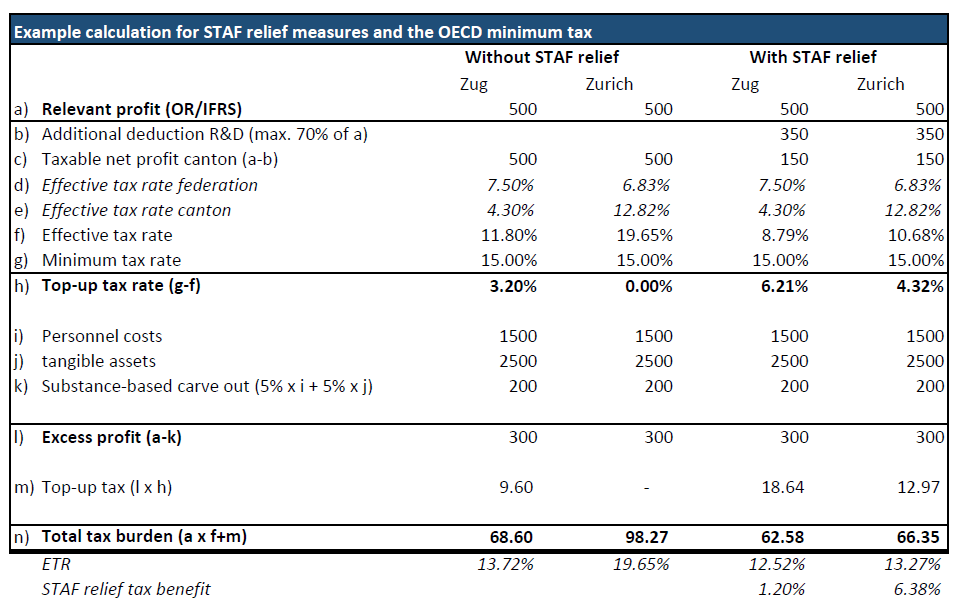

However, as the following example shows, such relief measures allow significant tax advantages to be achieved also under the OECD minimum tax. In the calculation of the top-up tax, the substance-based carve out is decisive in this respect – 5% of the effective costs for the employees working in a jurisdiction as well as 5% of the book value of the tangible assets located in a jurisdiction can be deducted from the calculation basis. The top-up tax is only levied on the excess profit calculated in this manner.

In the following example³, applying the additional deduction for R&D also in a low-tax canton means that the actual tax burden of 15% is significantly reduced. The disadvantage arising from the OECD minimum tax is cushioned by the additional deduction for R&D, whereas the effect in high-tax cantons is more significant.

The substance-based carve-out is higher in the first years after the introduction of the GloBE rules and is steadily reduced to 5%. Nevertheless, it allows Swiss companies with significant substance and a large workforce to achieve significant tax benefits also in the long term. Depending on the amount of the substance-based carve out, configurations may also arise where no top-up tax has to be collected despite STAF relief measures.

4. Conclusion

Despite the already low income tax rates in Switzerland, the STAF relief measures can still lead to tax benefits under the OECD minimum tax. It must be ascertained in individual cases which measures are suitable for the purpose of optimising the specific situation. Also affected companies that do not take advantage of STAF relief measures are advised to carry out an analysis of the specific effects of the OECD minimum tax on their particular situation.

¹ According to estimates, approximately 1% of companies in Switzerland are affected. The remaining companies are not affected by the minimum tax rate.

² According to the transitional rules, the amount of the deduction is steadily reduced from 10 per cent (wage costs) and 8 per cent (tangible assets) to 5 per cent each.

³ Cf. also EF 2022, 592 et seq.